Introduction

- TOP Airbnb cities in Alberta, Canada

- Why Airbnb in Edmonton is a Great Investment: A Comprehensive Guide

- Edmonton Airbnb Regulations

Unlocking the door to the world of Airbnb hosting can be both exciting and profitable, particularly in vibrant cities like Edmonton, Canada. However, with the extra income stream comes the responsibility of understanding and handling the tax implications. This often can be an overwhelming aspect of the hosting journey, filled with legal jargon and intricate guidelines.

In this comprehensive article, we aim to serve as your guiding light in the world of Airbnb taxation in Edmonton. We provide a definitive guide on the tax on Airbnb income, offering detailed insights into how it works, its legal aspects, and how to navigate your way through tax season effectively and confidently.

Whether you are a new host starting your Airbnb journey or a seasoned host looking to better understand the taxation landscape, this guide provides you with the critical tax knowledge you need. So, let’s embark on this financial journey and demystify the complexities of Airbnb taxation in Edmonton, Canada.

Airbnb in Context

Before delving into the taxation specifics, it’s helpful to understand the context and scale of Airbnb.

Airbnb: A Global Phenomenon

Airbnb is a worldwide platform facilitating short-term rentals of homes, apartments, or rooms. With more than 7 million listings worldwide as of 2021, it’s a significant player in the global tourism market.

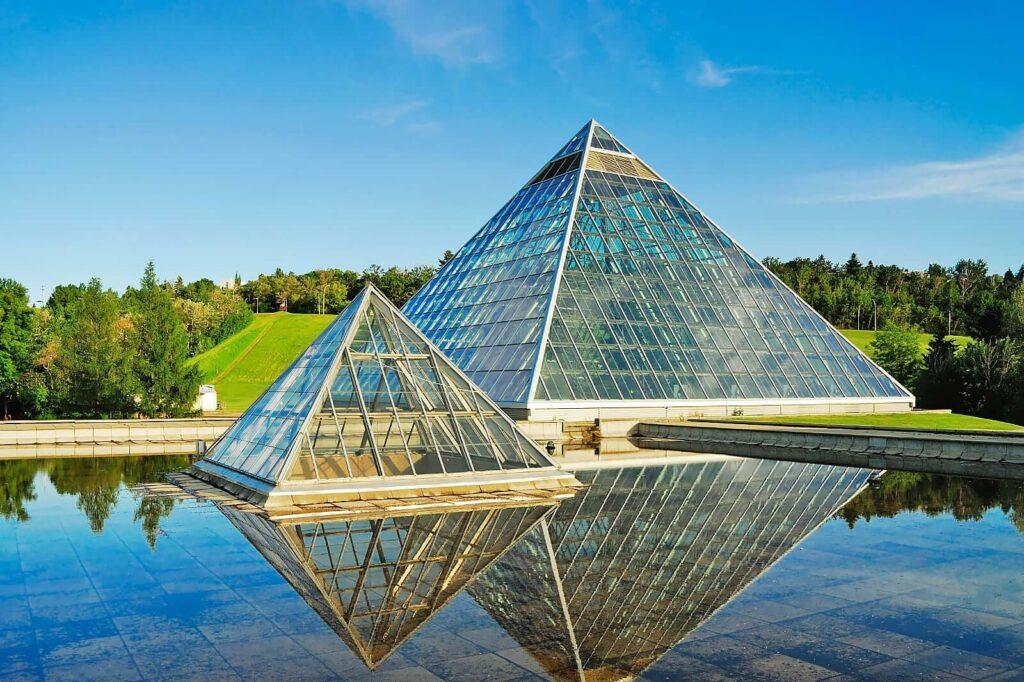

Airbnb in Edmonton, Canada

Edmonton’s Airbnb market has been growing steadily. As of 2021, the city boasted over 3,500 active listings, providing travelers with a diverse array of accommodation options.

Airbnb as an Income Source

When you list your property on Airbnb, it turns into a steady source of income. But remember, with extra income come extra tax considerations.

Your Rental, Your Business

Renting out property on Airbnb is, in essence, running a small business. This means earnings must be reported to the Canada Revenue Agency (CRA), with the average Edmonton host earning approximately $6,000 annually.

Demystifying Tax on Airbnb Income in Edmonton, Canada

Income Tax Basics

In Edmonton, and the rest of Canada, Airbnb rental income is taxable. Hosts must report this income on their annual tax returns, with the marginal tax rate depending on their total income for the year.

Expense Deductions: The Details

Taxpayers can reduce their taxable income by deducting relevant expenses. This includes cleaning costs, repairs, and a portion of your mortgage interest or rent. In 2021, the average Canadian Airbnb host could deduct about 40% of their rental income as expenses.

Capital Gains Tax: The Catch

Selling your property could incur capital gains tax on any profit made. However, exceptions exist if you’re selling your principal residence.

Legalities of Airbnb Taxation in Canada

The CRA’s Role

The CRA oversees all taxation in Canada. They provide guidelines for filing taxes on rental income, ensuring a fair tax system.

Airbnb’s Agreement with the CRA

Airbnb has an agreement to share information with the CRA about income earned by Canadian hosts. This information-sharing facilitates accurate income reporting and tax payment.

Tax Obligations for Airbnb Hosts

Every Airbnb host in Edmonton has a responsibility to understand their tax obligations. This involves accurately reporting rental income and claiming all eligible expense deductions.

Navigating Tax Returns as an Airbnb Host

Filing your tax returns doesn’t have to be a maze of confusion. Here’s a step-by-step guide to keep you on track.

Declaring Airbnb Income: When filing your tax returns, your Airbnb income must be declared under “rental income.” In 2021, Airbnb hosts in Canada earned an average of $4,100.

Claiming Expenses: You can claim a variety of expenses to offset your tax obligations, with the average Canadian Airbnb host claiming $2,200 in expenses in 2021.

Tax Filing Deadlines: Remember, tax returns must be filed by April 30th. If this deadline is missed, penalties can apply, such as 5% of the balance owed plus 1% of the balance owed for each full month the return is late, up to a maximum of 12 months.

Conclusion

Becoming an Airbnb host in Edmonton, Canada, is not just about providing a comfortable place for travelers; it also involves navigating through the complexities of tax obligations. Understanding the tax laws associated with your Airbnb income can help you optimize your returns, avoid penalties, and keep your finances in order.

Through this definitive guide, we hope we’ve clarified some aspects of the tax on Airbnb income. We’ve explored the scale of Airbnb in Edmonton, its implications as an income source, the nitty-gritty of related taxes, the legalities and roles of various entities, and how to navigate your tax returns. However, each host’s situation is unique, and there can be further complexities based on individual circumstances.

For this reason, seeking professional advice from tax experts or consultants is always a smart move. This can not only save you from potential legal issues but also help you utilize tax deductions and exemptions effectively.

In essence, being an Airbnb host can be a rewarding endeavor, and with the right tax knowledge, you can make the most of your hosting experience. Remember, staying informed and up-to-date on tax laws is the key to making your Airbnb venture truly successful!

- The Comprehensive Handbook: Navigating Airbnb Income Tax in Montreal

- Your Essential Guide to Understanding Tax on Airbnb Revenue in Toronto, Canada

- The Ultimate Handbook for the Taxation of Airbnb Income in Whistler

- Calgary, Canada: The Comprehensive Guide to Airbnb Income Taxes

- The Comprehensive Guide on Airbnb Taxation in Ottawa, Canada